In today’s rapidly evolving healthcare landscape, health plans are at the forefront of delivering innovative and member-centric products. With 1 in 5 Americans set to become an ‘older adult’ by 2030, addressing the fragmentation in the aging services space has never been more urgent.

The senior care landscape offers a range of solutions tailored to the diverse needs of the aging population:

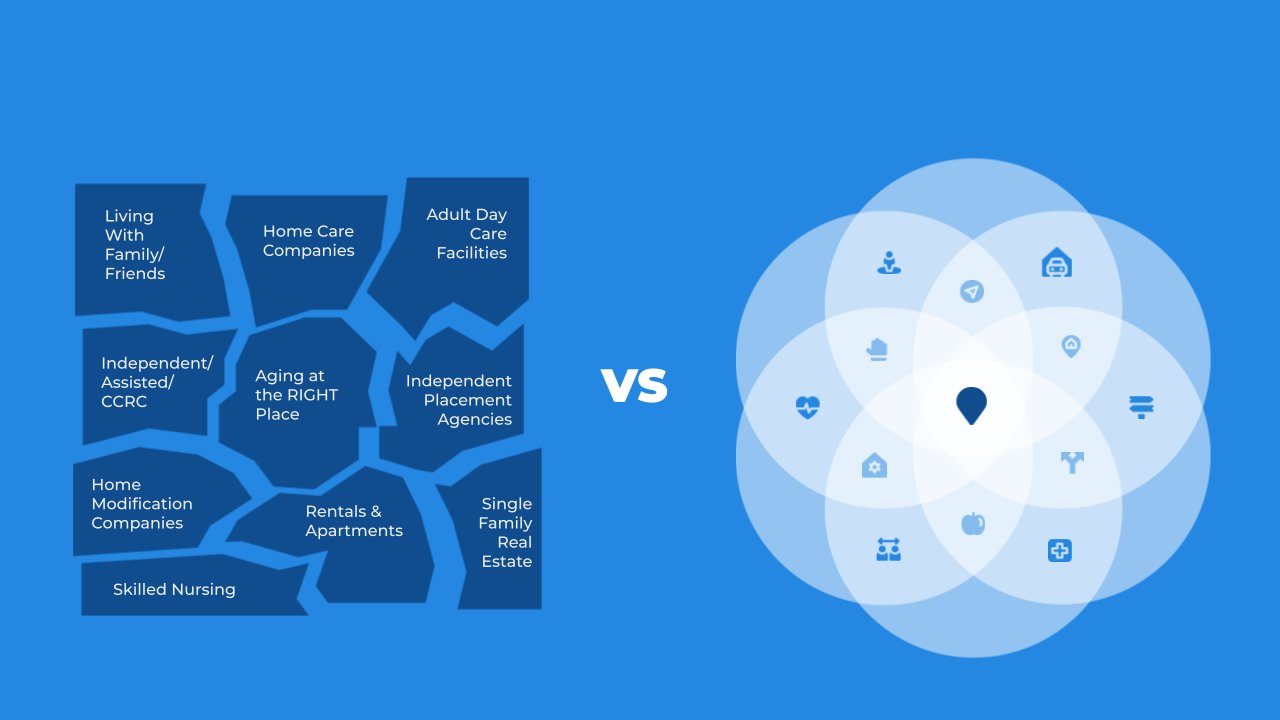

Navigating this intricate web is challenging. Factors like cost, location, medical needs, and personal preferences further complicate the decision-making process. Without a unified entity holding people’s hands through this process, families often feel overwhelmed. Guidance alone is insufficient.

Standards vary widely from one facility and care provider to another, leading to disparities in care and support. Older adults often find themselves navigating a complex web of options, unsure of which path to take. Critically, this lack of clear direction can lead to poor housing choices, which in turn can have detrimental effects on seniors’ health and well-being. The $740 billion senior care market is vast, yet fragmented. Moreover, the NAIOP report suggests that the senior services sector is poised for growth, further emphasizing the need for a unified approach.

For health plans, this fragmentation is both a challenge and an opportunity. By serving as a trusted force, health plans can enhance seniors’ quality of life and align with their goal of delivering member-centric and innovative benefits and programs.

While the majority of seniors want to age in their homes, the reality is that many find themselves in inaccessible or unsuitable housing situations. At first glance, many in the industry tend to think of housing instability as primarily an affordability challenge. It’s not. We’ve learned this from our tens of thousands of interactions with older adults. This disconnect is often exacerbated by the prevalent “Screen & Guide” approach in the healthcare industry. In this model, seniors are typically assessed or screened for their needs, based on a few questions centered around affordability or housing quality, and then directed to a website or resource, leaving them to navigate the complex world of senior housing and care on their own. This can be overwhelming, especially when faced with the myriad of options and considerations unique to senior services. In most cases, this ‘Screen & Guide’ approach also doesn’t ‘close the loop’ on cases, never fully ensuring safe and stable housing for members.

Upside, on the other hand, employs a “Screen & Intervene” approach. Rather than merely guiding seniors to resources, Upside actively navigates and intervenes, providing hands-on support every step of the way. From understanding an individual’s ‘whole person’ needs to assisting with transitions and ensuring the right fit, Upside is there to bridge the gap between this desire and reality. This proactive engagement ensures that seniors are not left to figure things out on their own but have a trusted partner guiding them through the process. This approach has a lot of benefits, both for the health plan and for the members themselves.

The desire to age safely and healthily is strong among older adults, yet the lack of a unified and end-to-end model makes this dream challenging to achieve for many. With Upside’s interventionist approach, the dream of aging in the right place becomes a tangible reality for more seniors.

In the face of an aging population and a fragmented senior services landscape, the need for innovative, cohesive solutions has never been clearer. As we look to the future, it’s essential to prioritize the desires and needs of our seniors, ensuring they have the support, resources, and environments conducive to aging gracefully. With proactive approaches like Upside’s “Screen & Intervene” programs and the integration of technology and community-focused initiatives, we will pave the way for a brighter, more unified future for older adults everywhere.